- Get Extra

- Individuals

- Business

- Tools

- Tax Courses

- Contact

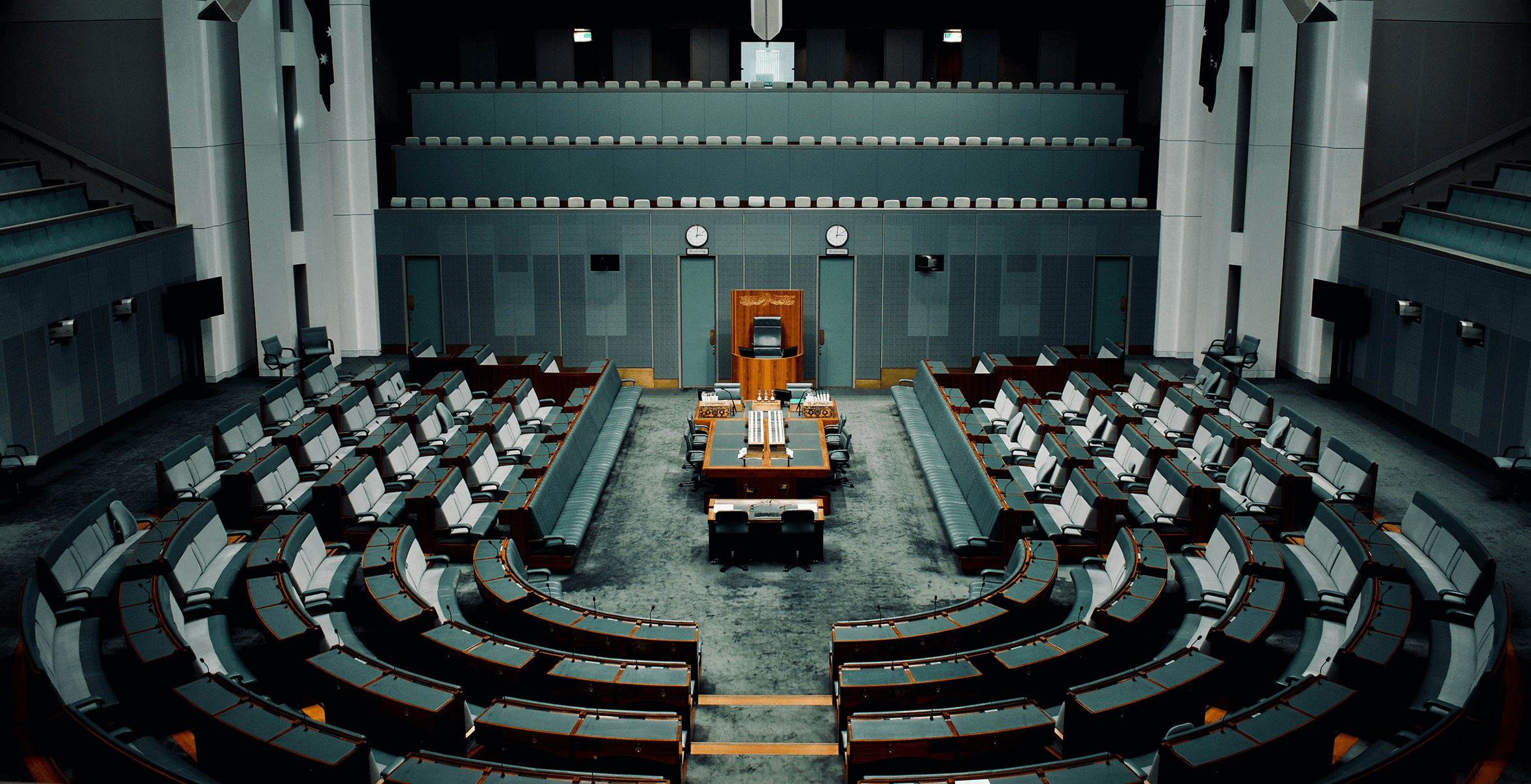

Federal budget 2024. How does it impact you?

Wednesday, 15th May 2024

Treasurer Jim Chalmers has just unveiled the government's third budget, marking a significant move with a $300 reduction in power bills for every Australian household.

While this measure aims to alleviate the burden of living costs, the budget remains cautious in its spending, navigating the delicate balance between providing relief and preventing inflationary pressures from escalating. Delve into this overview to understand the key highlights of this year's budget and how they may impact you.

Tax Changes and Relief

The 2024 budget introduces several tax cuts designed to alleviate financial pressures:

- Tax Cuts: Middle-income earners are the big winners. For instance, if you earn $50,000 annually, you'll get a tax cut of $929. Couples with combined incomes of $75,292 and $60,000 will receive $2,740 in tax cuts.

- Medicare Levy Adjustments: The income thresholds for the Medicare levy have been increased, allowing more low-income earners to either be exempt from the levy or pay a reduced rate.

- Energy Bill Relief: Starting from 1 July 2024, households will receive a $300 rebate on their electricity bills, while eligible small businesses will get $325. This initiative aims to help manage rising energy costs and ease inflationary pressures.

Cost of Living Support

To combat the rising cost of living, the government has introduced several supportive measures:

- Rent Assistance: An additional $1.9 billion over five years has been allocated to increase Commonwealth Rent Assistance by 10%, which will help many renters manage their housing costs.

- Cheaper Medicines: A $3.4 billion investment in the Pharmaceutical Benefits Scheme (PBS) will make medicines more affordable, ensuring better access to essential treatments.

Health and Medicare

Several health initiatives have been funded to ensure better healthcare for Australians:

- Medicare and COVID-19: The budget allocates $825.7 million to ensure continued access to COVID-19 testing and vaccinations. Additional funding is also provided for sport and mental health programs.

- Aged Care: A significant $2.2 billion is dedicated to aged care reforms, including more Home Care Packages to help older Australians stay at home longer if they prefer.

Support for Families and Gender Equality

The government has introduced measures to support families and promote gender equality:

- Paid Parental Leave: Starting from 1 July 2025, superannuation will be paid on government-funded Paid Parental Leave. This change aims to improve retirement outcomes for parents taking career breaks to care for young children.

- Gender Equality Strategy: The first national strategy for gender equality has been released, which includes measures to improve women's economic participation and safety.

Education and Student Support

The budget provides significant support for students and education:

- Student Debt Relief: The government will cut $3 billion in student debt and cap the HELP indexation rate to reduce financial burdens on students.

- First Nations Education: Funding will be provided to support First Nations students and early childhood education programs.

Indigenous Communities

The government is investing in initiatives to support Indigenous communities:

- Economic Empowerment: A $777.4 million investment will create jobs and support community development in remote areas.

- Housing and Services: A partnership with the Northern Territory Government will improve housing conditions and provide essential services in remote communities.

Infrastructure and Environment

Investments in infrastructure and the environment aim to support sustainable development:

- Renewable Energy: Significant funding is allocated to integrate renewable energy sources into the grid and support clean technology.

- Urban Development: Continued investment in transport and communication infrastructure to support urban and regional growth.

Mental Health and Disability Support

Support for mental health and disability services is a priority in this budget:

- Mental Health Services: An $888.1 million package will enhance mental health services, including new digital and walk-in centres.

- NDIS Reforms: An additional $468.7 million will support reforms to the National Disability Insurance Scheme (NDIS) and improve services for people with disabilities.

In summary, while there are mixed outcomes in Australia's Federal Budget, it is clear that the government is taking cautious measures to promote the greater good of the Australian people. If any of outcomes affect you and your family and you need a second opinion how you can benefit or overcome what is being planned, please reach out to ITP Queensland today. We're always here to help and prepare you for greatness, no matter what the circumstances are.

More power to you, Qld!